20+ Whole life insurance

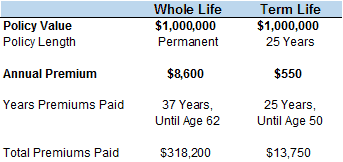

Whole life insurance is certainly more expensive than term but you get what you pay for- more benefits that never expire. This is contrary to term life insurance that provides coverage for a set period of time such as 20 years.

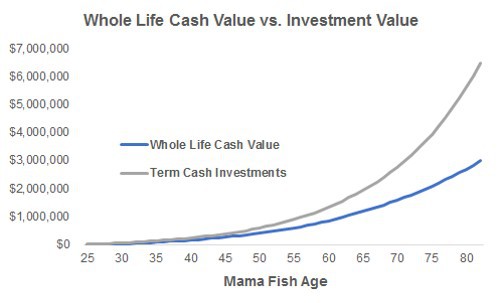

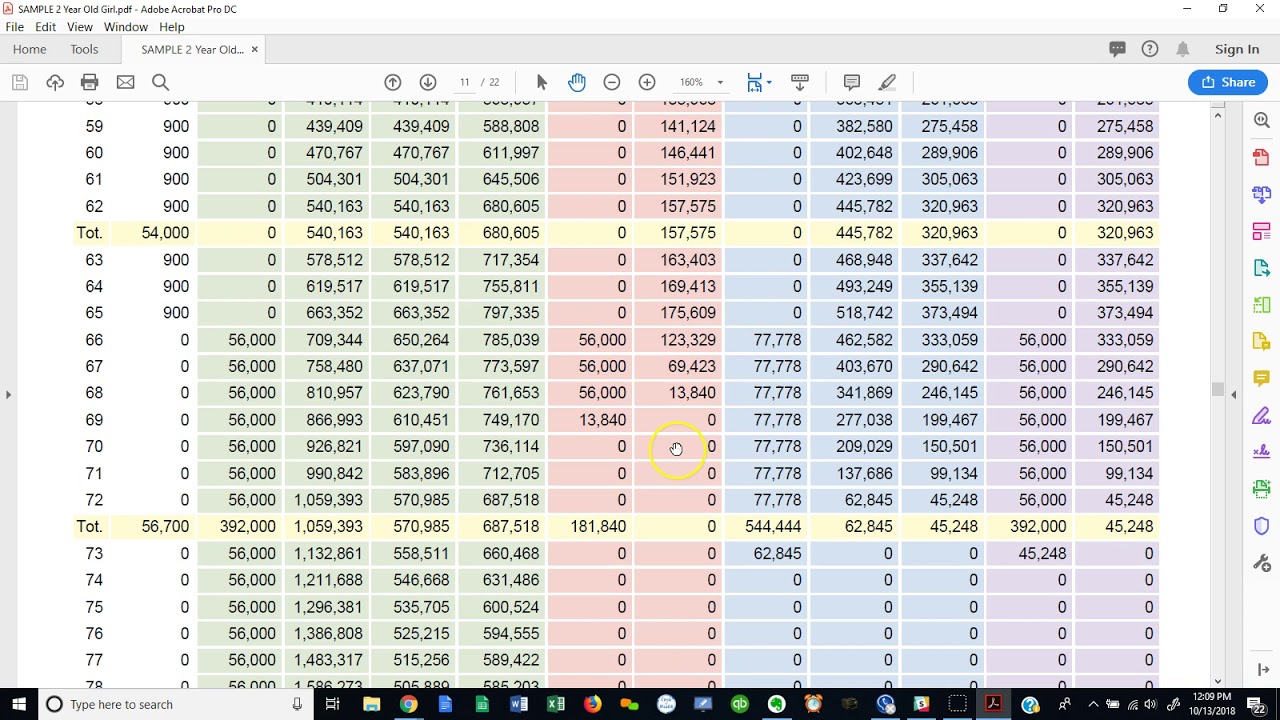

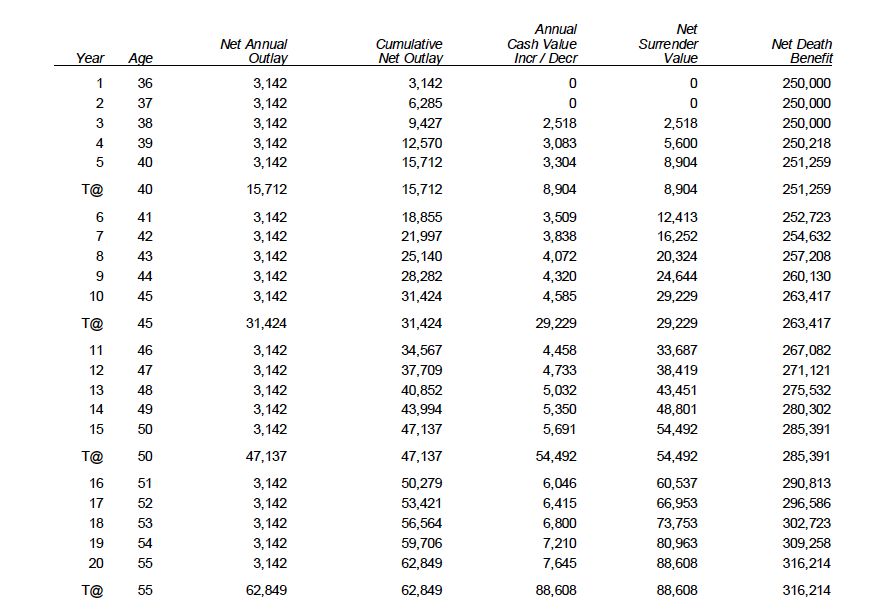

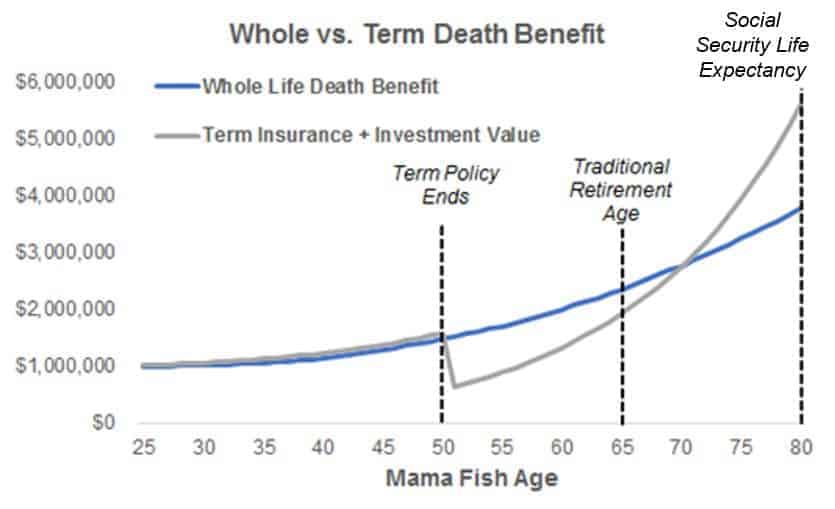

Whole Vs Term Life Insurance Let S Do The Math Smart Money Mamas

A 20 Pay Life Insurance Policy is designed for people who are looking for limited level premiums with cash value growth and permanent death benefit protection.

. State Farm Whole Life insurance policies offer level premiums and life insurance protection for as long as you live provided that premiums are paid as required to. You can get up to 5 million in coverage without taking a medical exam if youre 50 or younger up to 1 million if youre 51 to 60 years old on Whole Life 100 and 20-Pay Whole. If you dont have one our life insurance specialists are here to help.

The average cost of a final expense policy is generally 50-100 per month for roughly 10000- 15000 in coverage. You pay 20 level annual. Unlike term policies that can expire after 10 or 20 years whole life insurance lasts until the.

What Is Whole Life Insurance. The primary obligation to you is that you continue to pay the monthly premiums on the policy. 20 Pay Life Insurance 1 Available for ages from 0 75 Policy amounts available from 15000 to 4 million Policyholders receive lifetime protection in exchange for paying a certain number of.

The Bottom Line. Whole life insurance is an option that provides coverage for an entire lifetime. As its name suggests whole life insurance can cover you for your entire life.

Whole life insurance coverage offers a variety of valuable benefits such as. It is highly recommended you get a minimum 20 to 30-year term life insurance policy. Rates are calculated for female and male non-smokers in a Preferred health classification obtaining a whole life insurance.

Whole Life Insurance Quotes for 20-29 Years Old. The list is based on annualized premiums for 2020 according to LIMRA a research group for the financial services. Whole life insurance or whole of life assurance in the Commonwealth of Nations sometimes called ordinary life is a cash value permanent life insurance policy where the cash value is.

Give us a call today at 1-866-207-9160 for a no-obligation consultation. Although the exact price depends on your insurability. Whole life insurance calculator term life insurance aig whole life insurance permanent whole life insurance definition of term life insurance policy affordable whole life insurance guardian.

Thats in contrast to term insurance which covers you for a. Whole life policy features. This is life insurance with a policy term of 20 years.

20 Pay whole life insurance quotes Methodology. Below are the biggest sellers of whole life insurance in alphabetical order. If the policyholder dies during that time the life insurance company pays a death benefit to his or her beneficiaries often dependents or.

These policies are a great middle ground policy as they are not too short nor too long. A whole life insurance policy with a 20 pay option means that all premiums required to keep the policy in force for your entire life will be paid in 20 years. Whole life insurance guarantees payment of a death benefit to.

Even if you cannot afford a permanent life insurance policy most 20-somethings can receive very good term policies for very low costs such as 200000 to. Schedule a call Hours of operation are 930 am. You can add value to Whole Life Guaranteed 20 Pay with additional coverages Long-Term Care Advance Long-Term Care Advance provides affordable permanent life insurance coverage and.

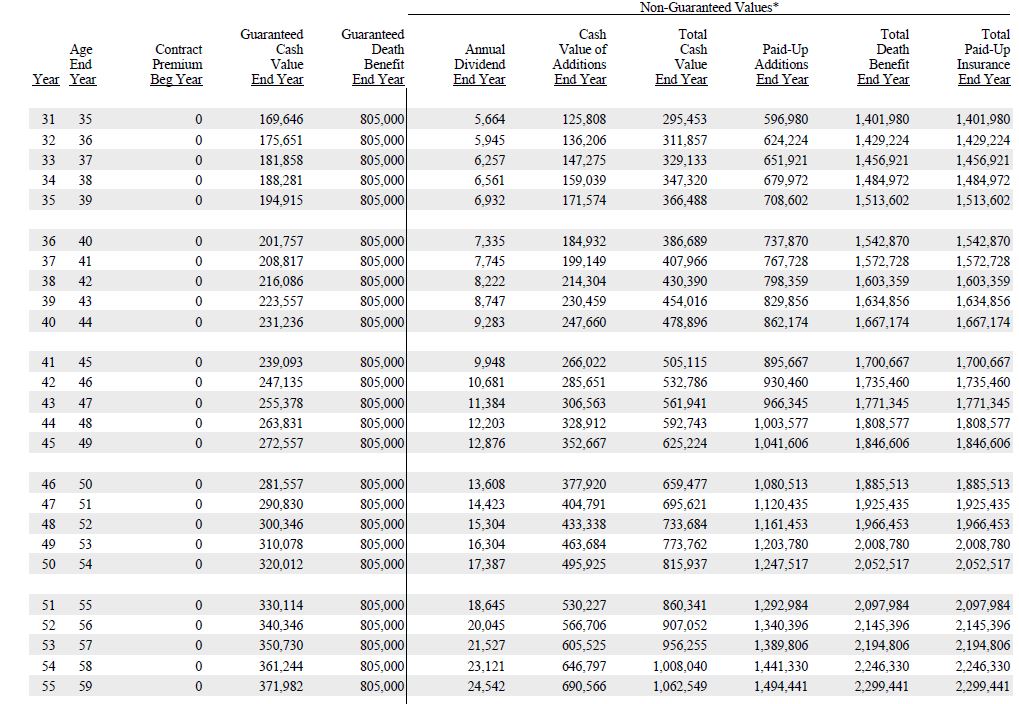

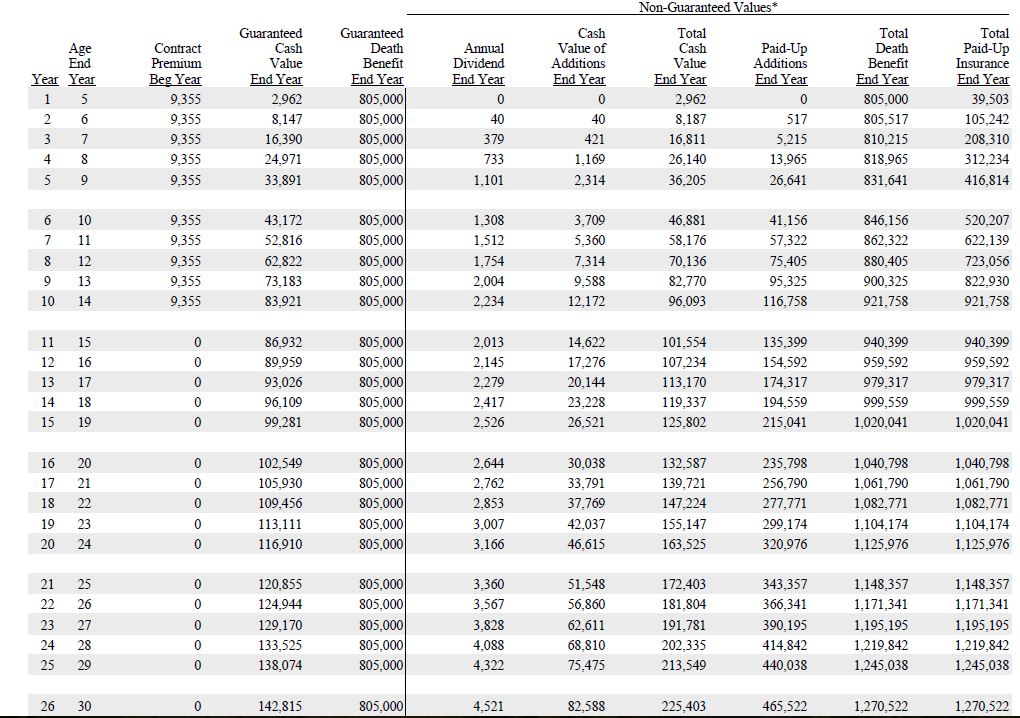

20 Pay Whole Life Insurance Quotes The following sample 20 Pay Whole Life Insurance Quotes are from an A rated carrier or better for a preferred plus male.

Term 20 Life Insurance Quotes Rates Expert Tips

What To Do If Your Term Life Insurance Policy Goes Higher Upon Renewal

Life Insurance For Children A Look At The 4 Best Policies

Life Insurance For Children A Look At The 4 Best Policies

Should I Cancel My Old Whole Life Insurance Policy You Have Options

Why Whole Life Insurance Is A Bad Investment Mom And Dad Money

Term 20 Life Insurance Quotes Rates Expert Tips

Whole Vs Term Life Insurance Let S Do The Math Smart Money Mamas

Life Insurance For Children The Best Policy For Your Kids

Life Insurance For Children A Look At The 4 Best Policies

Prudential Term Life Insurance Conversion All 4 Policies

Is Whole Life Insurance Right For You

What To Do If Your Term Life Insurance Policy Goes Higher Upon Renewal

Life Insurance For Children The Best Policy For Your Kids

Life Insurance For Children A Look At The 4 Best Policies

Term Life Vs Whole Life Insurance Understanding The Difference

Whole Vs Term Life Insurance Let S Do The Math Smart Money Mamas